To allow CPF members adjust to the new mechanism the SMRA rate has been put under, the Government will maintain the 4.0% floor rate for two years, from 1 January 2008 to 31 December 2009, if the 10YSGS yield plus 1% is below 4%. After 31 December 2009, the 2.5% floor rate will apply for all CPF accounts. This means that the CPF savings earn a minimum risk-free interest of 2.5% guaranteed by the Government. The fear of fluctuating CPF interest rate, which is possible of dropping to 2%, due to the floating aspect was put in place by this 2.5% guarantee.

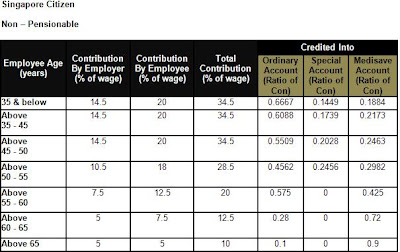

An additional 1% interest will be paid on the first $60,000 of a member’s combined balances, with up to $20,000 from the Ordinary Account (OA). This means that the other $40,000 must come from SA or MA. If you look at the structure of contribution allocation from your total CPF contribution, you will realise that OA has the highest allocation rate of 67%, while SA and MA stands at 14% and 19% respectively (I chose the rate that is applicable to the majority).

Assuming fixed $2,500 monthly salary throughout, total absolute CPF contribution amount is $862.50/mth. Out of this amount, $577.86/mth goes to OA $120.75/mth goes to SA and $163.88/mth goes to MA. Let's put this to further Math.

Assuming CPF interest rate of 3.5% throughout and salary increment of 3%p.a., this case study shows that a CPF member would take about 6 years before accumulating more than $60,000 altogether.

Therefore, CPF members who are most likely to benefit from this extra 1% are those who have been in the workforce for 6 years.

The additional interest received on the OA will go into the member’s Special or Retirement Account to enhance his retirement savings. This means that the additional interest earned will not be available for housing loan repayment nor child(ren)’s education. Instead, it will go into the Special Account which we do not withdraw till retirement. However, if there is more than $30,000, the CPF member may invest the excess of $30,000.