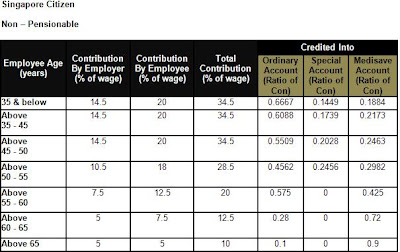

The CPF contributions are allocated to the Ordinary, Special and Medisave Accounts based on the ratio of contributions that varies according to age band, type of ownership and job sector. Contributions are first allocated to the Medisave Account, followed by the Special Account. The balance is then allocated to the Ordinary Account.

Age band: The older you are the lower your CPF contribution rate by yourself and your employer. However, the older you are the higher allocation rate that goes into your Medisave Account. Ordinary Account allocation rate will decrease as you rise up above the age ranks. Once you reach the age of 55, the allocation of your CPF contribution towards Special Account will cease.

Type of ownership: The two categories of ownership here refer to Singapore Citizens and Singapore Permanent Residents (PRs). Singapore Citizens contribute a standard rate across the board, notwithstanding the consideration of job sector. Singapore PRs contribute a lower rate in the initial 2 years.

Job sector: Job Ownership is basically divided into two categories – Non-Pensionable VS Pensionable. Under non-pensionable includes: (1)Private Sector Employees, (2)Government Non-Pensionable Employees, (3)Non-Pensionable employees in Statutory Bodies & Aided Schools. Under pensionable includes: (4)Government Pensionable Employees, (5)Pensionable Employees in Statutory Bodies & Aided Schools

Note(1)

Maximum contribution for the private sector is calculated based on a salary ceiling of $4,500 for both the employer and the employee.

Note(2)

Maximum contribution for Non-Pensionable Employees in Government Ministries and Statutory Bodies & Aided Schools are calculated based on a salary ceiling of $4,500 for both the employer and the employee.

Note(3)

Maximum contribution for Pensionable Employees in Government Ministries and Statutory Bodies & Aided Schools groups are calculated based on a salary ceiling of $6,000 for both the employer and the employee.

Job sector: Job Ownership is basically divided into two categories – Non-Pensionable VS Pensionable. Under non-pensionable includes: (1)Private Sector Employees, (2)Government Non-Pensionable Employees, (3)Non-Pensionable employees in Statutory Bodies & Aided Schools. Under pensionable includes: (4)Government Pensionable Employees, (5)Pensionable Employees in Statutory Bodies & Aided Schools

Note(1)

Maximum contribution for the private sector is calculated based on a salary ceiling of $4,500 for both the employer and the employee.

Note(2)

Maximum contribution for Non-Pensionable Employees in Government Ministries and Statutory Bodies & Aided Schools are calculated based on a salary ceiling of $4,500 for both the employer and the employee.

Note(3)

Maximum contribution for Pensionable Employees in Government Ministries and Statutory Bodies & Aided Schools groups are calculated based on a salary ceiling of $6,000 for both the employer and the employee.

Note(4)

SPRs' contribution rate is much complex as CPF board further segregated the SPRs CPF members within those that are pensionable into those working in the Ministries and those working in the statutory boards.

No comments:

Post a Comment